Automated Statements vs Automated invoice reminders : Which one is more effective?

Automated Statements vs Automated invoice reminders : Which one is more effective

We had a customer who recently asked the exact same question out of Automated Statements vs Automated invoice reminders which one is more effective. We thought why don’t we use our expertise , helping 1000’s of businesses automate their receivables and the live data we have , to answer that question.

Short answer : It depends on multiple factors such as – invoice value , invoice creation frequency for the customer , customers payment method , customer requiring more follow ups etc

What are Automated statement reminders ?

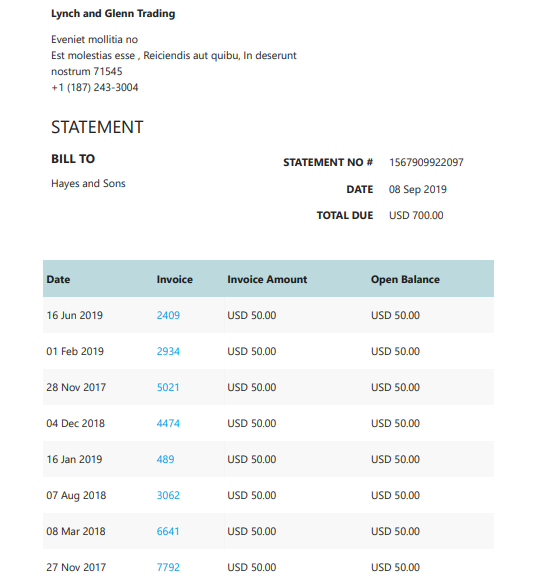

A statement is a summary of all the invoices a customer owes you with details such as totals.

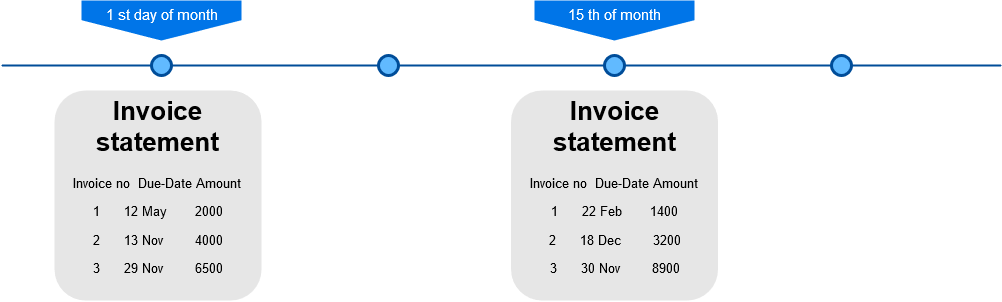

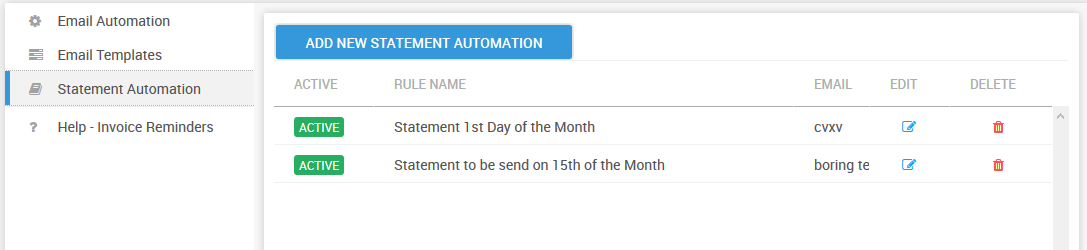

An automated statement reminder is a feature provided by a receivables management software to let you send statements automatically on a set period .

For eg : Send statements with all due invoices on the 1st day of the month or middle of the month

What are Automated invoice reminders ?

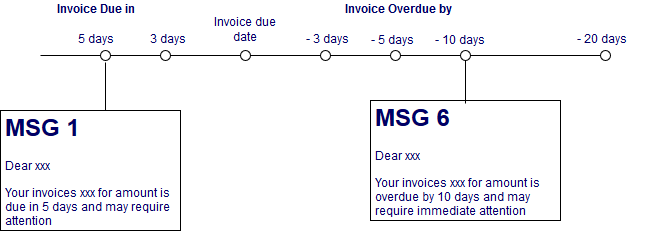

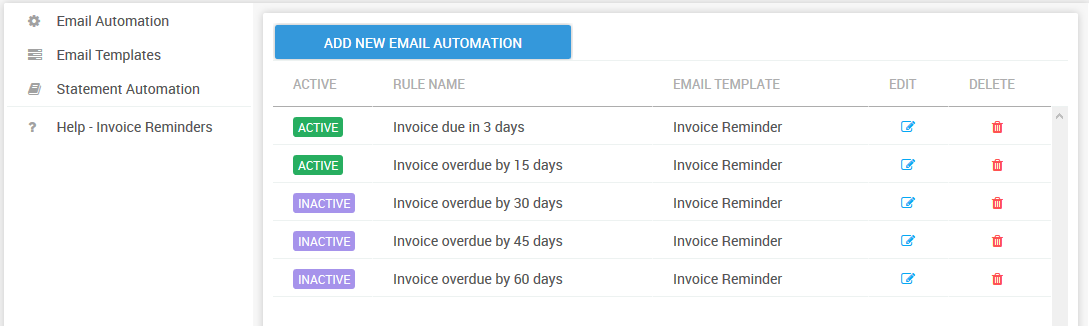

Automated invoice reminder is a feature provided by a receivables management software to send email automatically based on a trigger such as Invoice going to be due in 3 days or invoice overdue by 5 days.

Unlike Statements , invoice reminder emails contain only the invoice affected by a trigger event set and not all the invoices open for that customer.

Sending invoice reminders in this form allows businesses to bring to attention of the customer to a particular invoice that needs to be paid immediately as it meets the rules set in the trigger event.

Invoice reminders are mostly useful when the no of invoices generated are not too many per month or if the invoices are of low value since manually following up each of those invoices may not be worth the effort.

Invoice reminders are also useful when a business wants to bring to attention a particular invoice that has been due for a longer period and needs immediate action

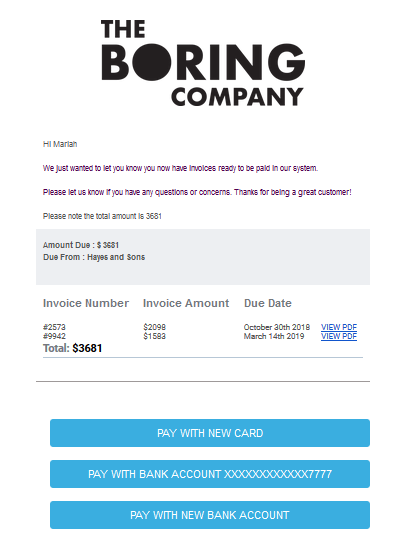

What should an Automated statement reminder contain ?

A statement reminder should contain all the invoices that are due in a tabular form with columns containing the invoice number , invoice due date , invoice amount and the total amount due.

It should also customers to share the doc within the organisation easily and the ability to see more the full invoice if required.

It should also allow customers to pay off all or certain invoices right from the email

The below pdf shows a sample statement reminder email sent from a receivables management software.

What should an Automated invoice reminder look like?

An automated invoice reminder should have the details of the invoice that you want to bring to attention in front of a customer.

It should also have the actual invoice pdf , details of whom to contact in case of questions and link to pay them quickly with limited no of steps.

Should a customer be setup on statement reminders / Invoice reminders ?

The answer to this question depends on various parameters such as

- Does the particular customer have huge volume of invoices created per month in your system ( more than 7 invoices per month ) . A periodic statement may be more suitable in this case

- How many invoices of the customer is open as of a given date . If the answer is more than 20 the customer may best be setup for statement reminder

- Is this customer a repeat business customer and do you have a long standing relationship with the customer.A periodic statement may be more suitable in this case

- Does the customer usually pay you by check or cash or other offline means ? A periodic statement may be more suitable in this case

- Does the customer usually prefer paying via electronic means on a certain day before due date ? Automated invoice reminder may be suitable in this case

- Is the customer a first time customer ? Automated invoice reminder may be suitable in this case

- Is the value of invoice usually low for this particular customer .Automated invoice reminder may be suitable in this case

Some usual reminder rules that may work for your business

Rule Sample 1 ( Customers with huge volume of invoices created every month)

- Send a statement with all due invoices on the first day and 15th day of the month

- Send an invoice reminder 3 days before due date

- Send an invoice reminder 15 days after it becomes over due

Rule Sample 2 ( Customers with low volume of invoices of low value – less than 200 USD or a new customer )

- Send an invoice reminder 3 days before due dateh

- Send an invoice reminder 5 days after due date

- Send an invoice reminder 15 days after due date

- Send an invoice reminder 25 days after due date

Rule Sample 3 ( Customers who ususally pay via check and has high no of open invoices )

- Send a statement on 15 th of the month

- Send a statement on 30 th of the month

Does sending invoice reminders/statement reminders actually help reduce DSO

Research done actually suggests that it does .Well thought out reminder strategies are as effective as providing invoice discounts in getting paid on time .

The research (link above) talks about a field experiment done with micro-lenders in Uganda to test the effectiveness of financial incentives vis-a-vis payment reminders.

It was found that simple payment reminders were as effective as financial incentives in ensuring timely loan repayment.

Also published on Medium.