Hacks to Reduce Credit card fees using QuickBooks

Credit card fees continue to be a huge expense for most businesses.

Fees expressed in % can be pretty confusing and costly as the absolute value of fees can be huge for invoices that are of higher value

The below table shows how credit card fees grows with transaction amount

| Invoice Amount | Credit card fees(2.9%) | ACH fees |

| $100 | $3 | $1 |

| $250 | $7 | $3 |

| $400 | $12 | $4 |

| $500 | $15 | $5 |

| $750 | $22 | $8 |

| $1,000 | $29 | $10 |

| $1,500 | $44 | $10 |

| $2,000 | $58 | $10 |

| $4,000 | $116 | $10 |

| $8,000 | $232 | $10 |

| $15,000 | $435 | $10 |

| $30,000 | $870 | $10 |

Paying with a credit card makes sense when the value of the invoice is less than $1000.

Paying with a credit card does not make sense for invoices with a payable amount of more than $1000. More so when there are alternatives (cheaper options) available such as ACH.

Below we list down a few hacks, based on our experience enabling millions of dollars of credit card transactions, that help reduce credit card fees

Hack 1: Allow customers to pay via credit card only if the invoice value is less than $100

The easiest way to avoid paying huge credit card fees would be by not allowing your customers to pay using a credit card in the first place.

You could create a system where credit card payments are not allowed for invoices above a certain value.

This can be achieved as below –

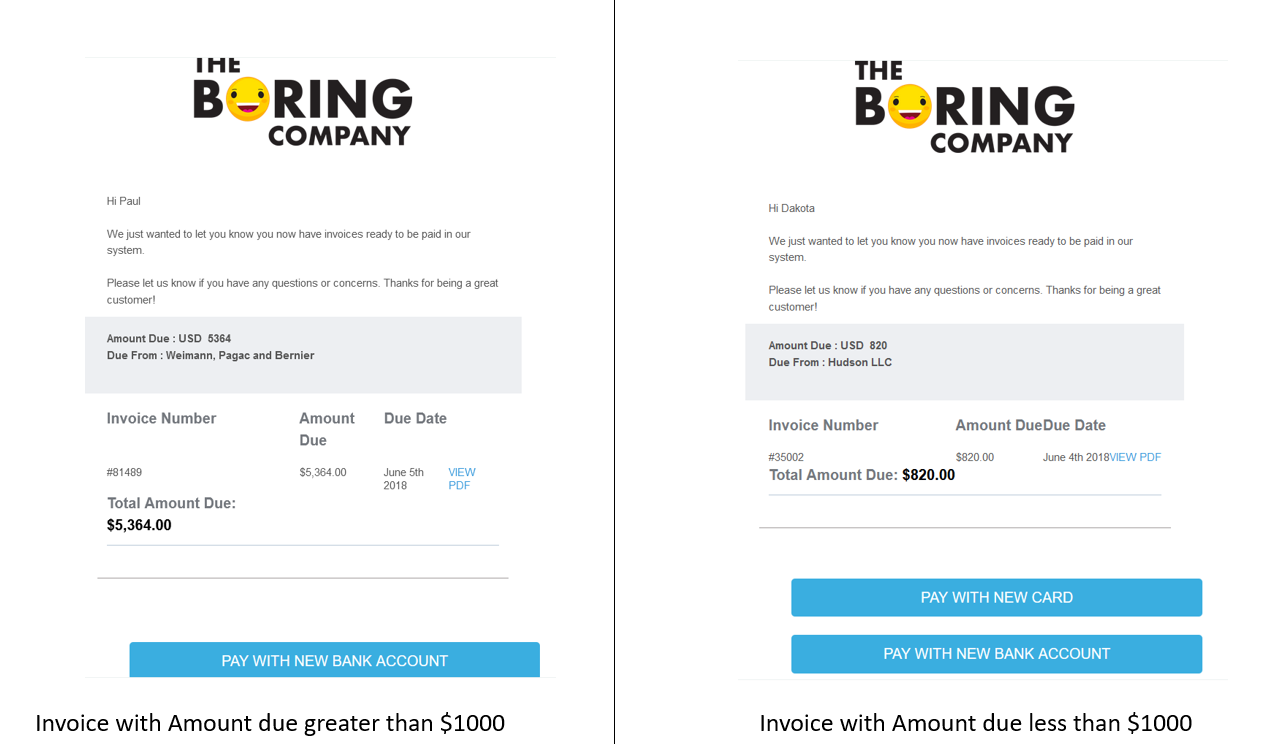

When you send a payment reminder for an invoice with an invoice amount greater than $1000, You could provide only a “Pay with Bank” option.

This is possible via the PayorCRM app by doing the following

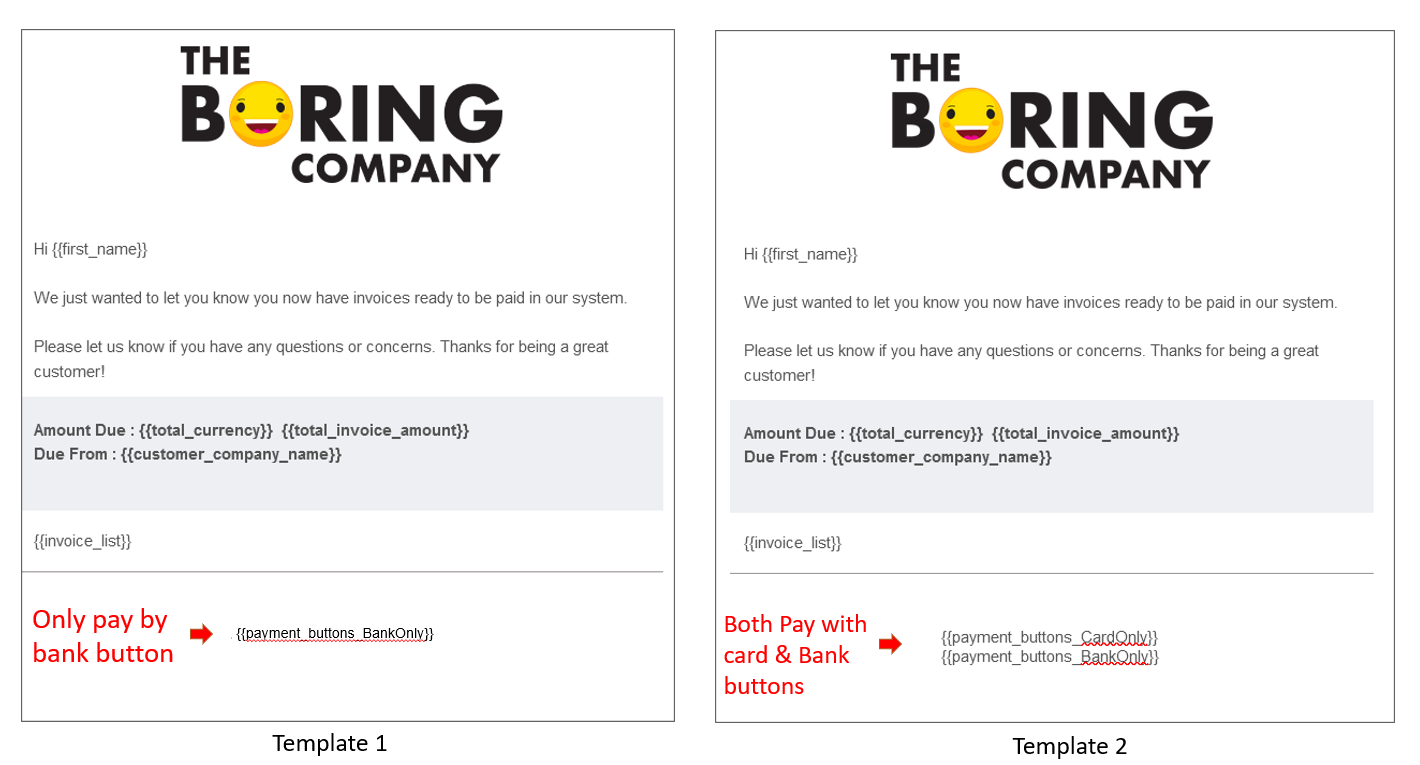

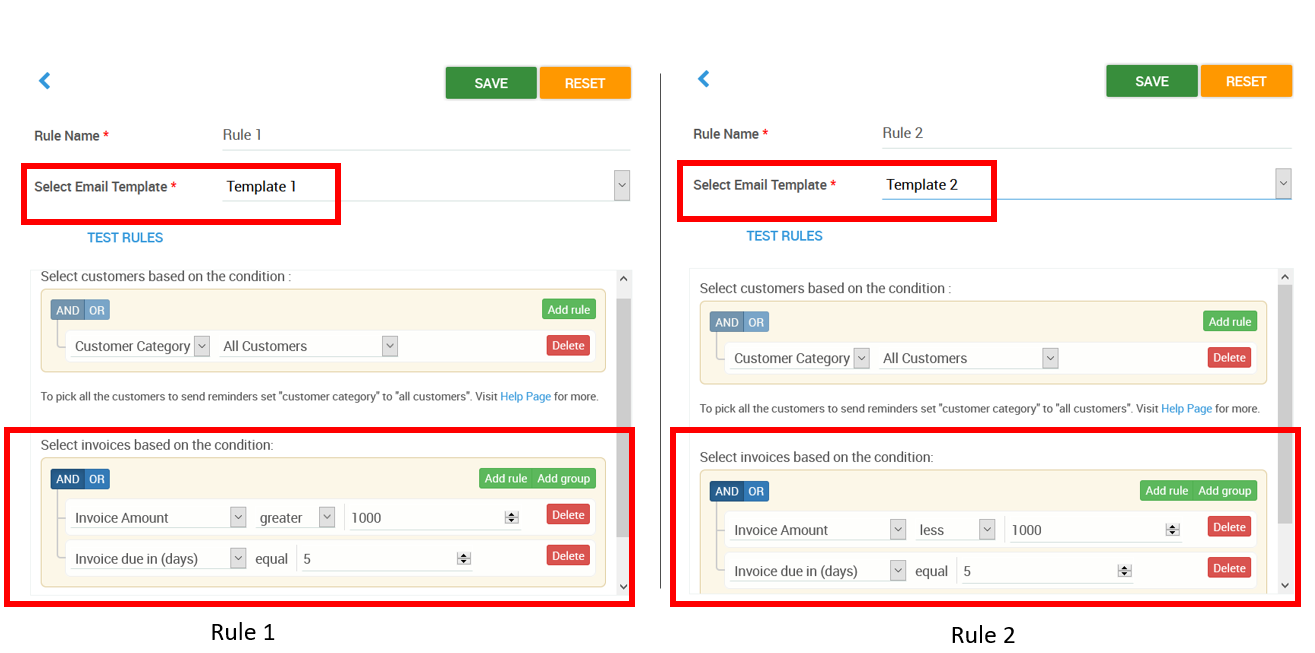

Setup up 2 email templates. One for users paying invoices less than $1000 and another for users paying invoices greater than $1000

Setup email rules for each of the templates you have set up before. Ensure that the rules have the condition invoice amount greater than or less than $1000By setting up the above automation rule, You will be able to make sure that customers paying higher invoice value will not have the option to pay via a credit card as can be seen below.

For more details on setting up invoice reminders, Visit our help section

Hack 2: Add surcharge fees

Charging a credit card surcharge fee automatically, while making a payment, is another way of avoiding credit card fees.

By doing so you are passing on the cost of credit card acceptance to your customers.

If you plan to add a surcharge fee for credit card payments, It is important to also provide an alternate option of payment that doesn’t have surcharge fees ( such as ACH).

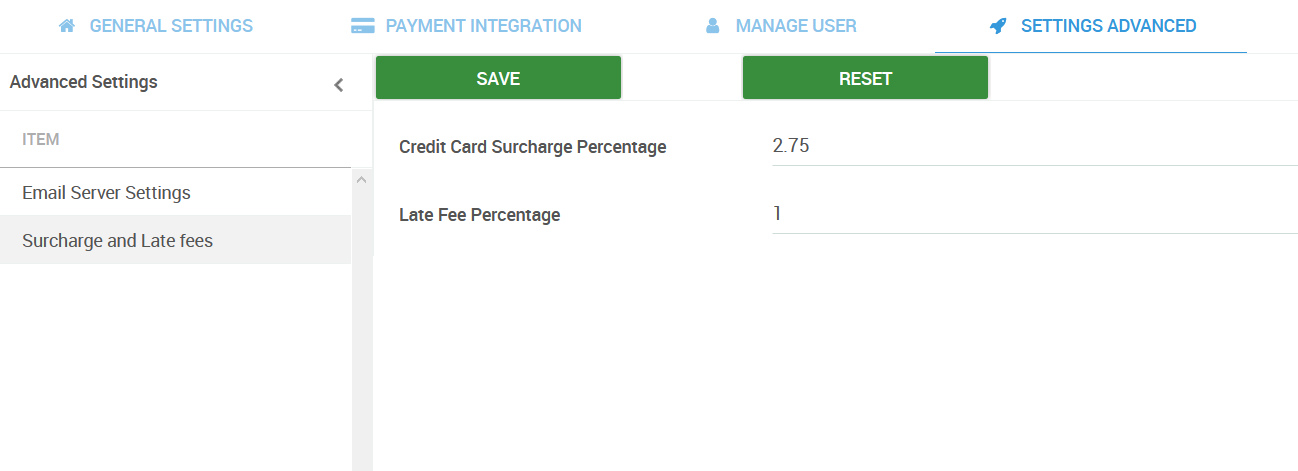

To set up CC surcharge fees on PayorCRM – Go to settings – Advanced settings – Add a credit card surcharge percentage value – Save

For more details on setting up surcharges, Visit our help section

Hack 3: Use a credit card processor that provides interchange-plus fees

This hack requires more effort on your part.

To understand how this helps, it is important to understand how credit card fee structures work.

Credit card fees come in two forms – Flat fees or interchange plus fees

Each of the above fee structures has its advantages and disadvantages.

As a thumb rule, Flat fees make sense if you are a small eCommerce business accepting low-value transactions (for eg: A Shopify store selling T-shirts and mugs)

Interchange plus fees are suitable for large businesses with more volume of transactions with a higher average value per transaction.

Flat fees: QuickBooks payments charges a flat fee (2.9%) for all Credit card transactions.

In reality, all card transactions may not be charged the same fee by the underlying card ecosystem.

The card fee charged depends on the fee charged by banks and card networks.

This varies from transaction to transaction based on the card brand, card type, geography, merchant type(MCC code), etc.

| Fee Components | Single flat fee |

| Flat fee formulae | 2.9% + $ 0.30 |

| Credit card fees for $100 transaction | $3.20 |

Interchange plus fees: A credit card processor that provides interchange-plus fees on the other hand provides a detailed break up of each of the costs involved along with the processing fees charged by them.

| Fee Components | Interchange rate | Assessment fees | Processor Fees | Total |

| Fee formulae | 1.80%+$0.10 | 0.11% | $0.25 | 1.91%+$0.35 |

| Credit card fees for $100 transaction | $2.26 |

As you can see from the above tables, A processor charging interchange plus fees may be cheaper than one charging a flat rate.

Reach out to us at [email protected] to know more about how you can Reduce Credit card fees using QuickBooks

Also published on Medium.