What is a “Payment collections software” ?

What is a “Payment collections software”?

Payment collections software is a software that allows businesses to create a process to manage debt collections and ensure that their DSO ( Daily sales outstanding ) is low thus ensuring that the business is always cash flow positive.

Most payment collection software supports an Automated payment follow-up process as well as a manual payment follow-up process.

Why use Payment collections software?

According to market research firm IDC, companies lose 20 to 30 percent in revenue every year due to various inefficiencies.

And yet, many companies continue to “make do” with their current applications and systems even though those may not be the right solutions.

That is a lot, right?

An inefficient payment collections process is the last thing a growing business needs.

No, follow-ups or broken follow-ups leads to untimely payments which lead to less cash in the bank which leads to a lack of cash to pay vendors / hire people or make new investments.

Humans are bad at doing repetitive tasks

Let’s be frank humans are bad at doing repetitive activities. They are best at doing creative tasks and tasks that require contact with other humans

If the follow-up process is completely human-dependent businesses are most likely going to see inefficiencies creeping through over time.

This is why businesses will need new tools to manage collections operations automatically along with humans to manage it.

A purely automated collections reminder ( think automated email reminders only) may not always be the ideal solution. Some of your customers may require a manual touch (read – calls and personalized emails )

Auto collections and manual collections

Following up customers for payments need to be a mix of automation and manual intervention.

The manual intervention being costly needs to be well thought out to ensure that the team is not following up with someone who would have paid just by sending a reminder email.

Also it wouldn’t make sense to spend valuable time following up manually a customer whose total outstanding is less than 50 USD ( for e.g. )

A good mix of Automated follow-ups, as well as manual follow-ups, will thus help businesses improve cash flows while reducing manual efforts required in follow-ups and reducing revenue leakage.

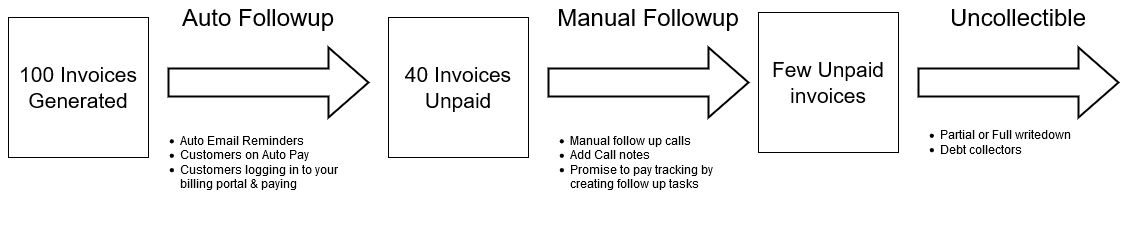

Consider a business generating 100 invoices every month.

Automation can help ensure (e.g.) that 60 invoices among the 100 get paid without needing to follow up manually.

Auto Follow up

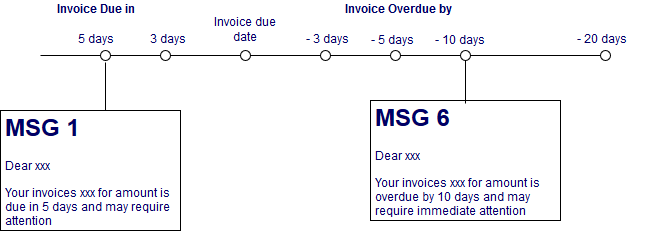

Some of the ways an automation campaign could be set up are as described below

– Send reminders 5 days before the due date

– Send reminders a day before the due date

– Send reminders 10 days after the due date

– Send reminders to “slow-paying customers ” 20, 25, 30, 40 days after it becomes overdue

.. Etc

See how you can set up the above using your accounting software – here

Manual Follow up

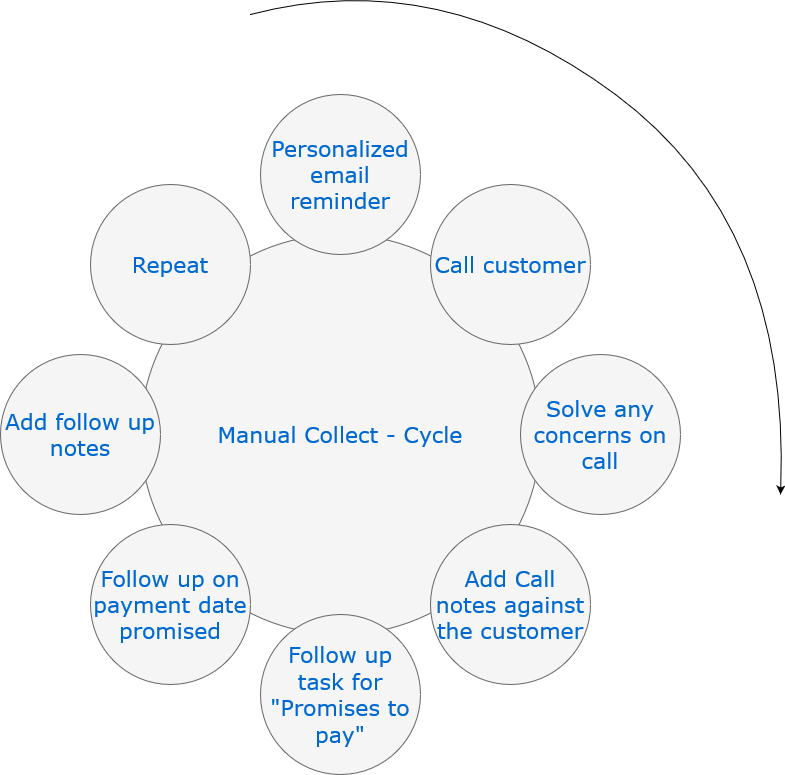

The rest 40 invoices ( from the above example ) will require some sort of manual intervention. The manual intervention could be in the following ways

– Sending a personalized email ( that doesn’t look like it came from an automation system ) asking about invoices due and tentative payment date.

– Calling the customer and sending them the open invoices to pay to their email id

– While on call solving any concerns the customer has about the invoice

– After the call adding notes to ensure that the call outcome is available for the future reference

– Adding tasks to follow up with the customer if the customer promises to pay on a certain date

Auto and Manual follow up strategies

Both manual and auto follow-ups need to have some underlying strategy

– Customers categorized as “slow paying needs” to be followed up 5+ times automatically

– Customers categorized as VIP need only 2 follow-ups

– Invoice amount greater than 500 USD needs to be followed up manually after the invoice is 15 days overdue

– Customers with invoice amount greater than 500 USD needs to be followed up manually after the invoice is 15 days overdue

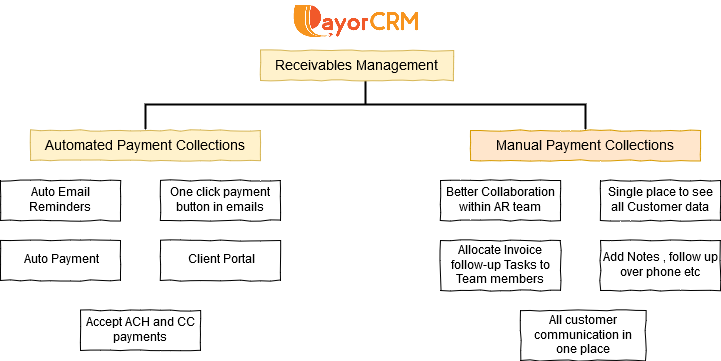

PayorCRM as a Payment collections software ( Shameless Sales pitch below 🙂 )

Even though there are multiple Payment collections software available in the market for managing Payment Collections operations PayorCRM is unique

It is built with the understanding that collections process is a mix of Automation and Human intervention

The below image shows a quick overview of how man & machine can work together to improve your businesses cash flow problems

Reach out to us via the contact page to know how best you can reduce the effort involved in following up on payments

Also published on Medium.