Collections software and payment processing software: Features to look for

1.Connects to your current billing /ERP /CRM

Data entry is a pain.It becomes a greater pain when your company uses multiple software for ERP , CRM or billing software.The ability to move data between these products in a integrated fashion should be your top-notch priority as any software should help you improve your team’s productivity and not make it worse. Your Collections software should hence be able to pull invoices and customer information from multiple sources and provide them to you in an intuitive interface

2.Combined collections software and payments software

Imagine you are sending a mail to your customer who has an overdue invoice. You technically want him to quickly pay. Sending a mail without giving details on how to pay you faster would be a poor experience. Imagine on the email with the list of overdue invoices you could add a pay now button which redirects the customer to a page where they can enter their credit card or bank account information to pay you then and there.By doing this you would not just you get paid faster, you also will be giving your customer a better experience of paying you.

3.Customer communications history within your collections software

As organizations add more customers and add more team members to your collections teams, It is imperative that there needs to be a single platform where all the communications sent to customer or calls made to the customer or notes is maintained. This helps in tracking who-is-tracking who and what is the update on those overdue invoices. Tracking customers and following up with them for overdue invoices is important. It’s also important that you are careful as to not destroy your company’s relationship with the customer by being overbearing / with unwanted follow-ups

It’s also important that the emails you send to remind them of an overdue invoice come from your official mail id.Your collections software should hence provide you the ability to use your own company’s mail servers to send emails from within the software instead of a generic email id such as “[email protected]”. Why? because it’s professional and it also lets your customer know whom to contact if there are any issues in the invoice

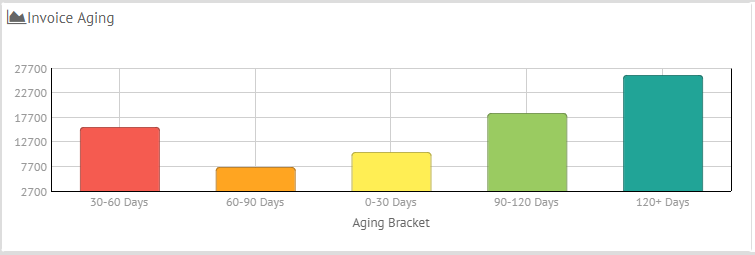

4. Categorization of invoices through various tags

The software should allow automated or manual tagging of your customer under various tags.For eg: Invoices could be automatically tagged under each overdue buckets such as 0-30 days, 31-60 days, 61 -90 days etc and the email message automatically sent to the customer could be based on which bucket the invoice lies in(dunning process).

Another example could be to tag customers under various categories for eg: “important”, “medium importance”, “very important” .The collection and payment rules can be defined such that the software follows up with the customer on overdue invoices according to how important the customer is to your business

To be able to select the right collections software your company would also need to analyze your collections software to look for areas of improvement and to come up with a good business case for subscribing for a collections software

How can you identify problem areas in your collections process?

1. Analyse the number of invoices processed/customer followed up by an employee in a month or a quarter. You’ll notice an impressive boost in productivity after automating your collections processing.

2. Calculate the cost of following up with customers to get paid on time.You can do this by analyzing the amount of time your collections analyst spends looking up invoices, contacting customers and following up.According to Paystream Advisor’s study, this could be an average of 100$ for an invoice excluding the cost of processing the payment.Yikes!

3. Gauge the timeliness of your customer payments. How many customers pay on time? Does all pay on time or just 50%

4. Check your current automation levels – Sorry – manually sending emails doesn’t count

5. Gauge the number of customers who are taking advantage of your early invoice payment discounts. Is it zero customers?Is it because you are not telling customers about early payment discounts. What if you could send a mail few days before about their expiry of early payment discount? An automated mail telling them few days before the early payment discounts will go a long way in getting your customers to pay on time!

6. Track the total discount amount claimed by your customers by paying early. The higher the better ! This may seem counter-intuitive! Hold on to that thought

7. Track the number of times customer orders that were blocked due to customer overusing their credit limit. Blocked orders are bad!

Your customer might take that cue to switch to your competitor’s product! Most of the time the customer don’t get enough notice that they have an overdue invoice. Automate !

8. Calculate the percentage of erroneous payments. Payment errors can lead to a bad customer experience. Consider the case where customers were provided an invoice with less than the actual amount due. Going back to the same customer for the difference amount is bad when it comes to customer experience. Letting your ERP automatically send invoice info to your payment software can solve this.

Why collections software needs to be combined with payment processing software?

1. Obvious reason being collection and payments are 2 sides of the same coin in any B2B business and hence need to be as closely integrated as possible

2. Collections analysts have a better view and can follow up with customer better. Some payment types are slow.Even though a customer might have initiated a payment today, the actual money wouldn’t reach the bank until a few days. It’s important that the analyst knows that the customer has initiated payment to avoid unwanted follow up in the intertwining time

3. One of the major activities of a collection analyst is customer communication to follow up for payments for overdue invoices. It makes sense to add payment option with a “Pay now” button right in the email when sending the list of overdue invoice. Some customers might be ready to provide you their credit card number when you are calling them on phone to get an update about an overdue invoice.It makes sense in both cases to hence provide collections team an integrated software that covers collections management and payment processing

Why have a collections software integrated with payment processing early on even if you are small?

Setting up the finance team around an integrated collections and payments process will enable your organization’s finance team to scale very easily