Accepting B2B business payments electronically online using credit card or direct bank transfers(ACH transfer)

Accepting B2B payments electronically isn’t any more a deviation from the norm as it used to be.

Most fortune 500 companies have either partially or completely moved to digital payment.

Companies, especially in the B2C space accepting payments from consumers, have completely switched to digital payments as the cost associated with other non-digital means as a percentage of the size of payment are high when compared to the cost associated with digital means as a percentage of the size of the payment.

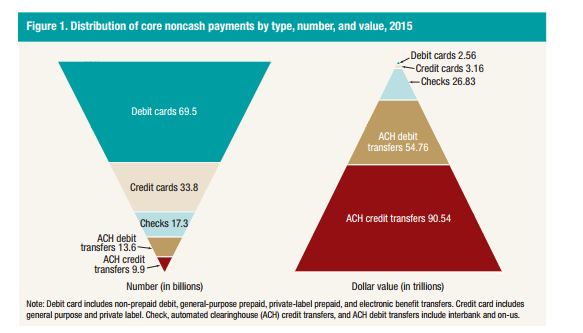

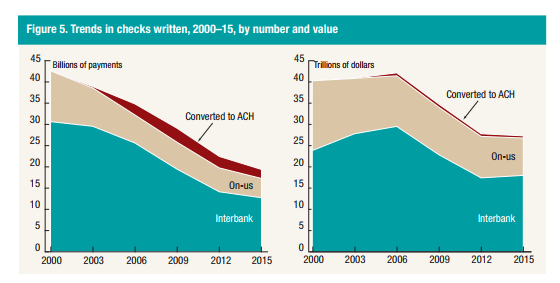

Companies serving B2B clients even though late have started the switch as the cost of processing has gone up as organizations expand and add new clients.Federal reserve study on payment transactions in US also points to this trend https://www.federalreserve.gov/newsevents/press/other/2016-payments-study-20161222.pdf

Source – US federal reserve study

Some of the major pain points organizations deal with when it comes to incoming payments are

- Payment delays – It could be caused by anything from the payment method used to accept payments to invoice /Cheque not reaching the customer or come gaps in customer communications in invoice presentments or storage of information or disputes

- Buyer side processes: Not all of your buyers may have integrated technology into their finance process.Your buyers may be still using age-old ways of keeping track of their payables.This inevitably leads to constant follow-ups and calls to the buyer.

- No workflow management tool within your collections dept: Lack of a standard workflow management tool usage by your collections team leads to haphazard follow-ups by multiple people in the organization

- Payments reconciliation errors: manual reconciliation leads to errors such as cases were Invoices that have been paid for are still shown as being not paid or payments applied to invoices that have not been paid

Accepting payments electronically through a self-service portal does for sure help manage the above issues to a certain degree and also helps improve the productivity of your team.

So you have the need to move to accept electronic payments.

You also have an idea of the number of customers who will most likely move to electronic payments and you feel the number of customers who will be ready to move to electronic is big enough.The next step is selecting the payment method

What are the ways I could accept business payments? Should I accept only credit card payments? Should I accept only bank to bank transfers? Should I accept PayPal payments? Or is there any other method that makes sense? Blockchain?

Accepting credit card payments

When does it make sense to accept credit card payments?

Accepting Credit card payments makes sense especially when you accept a lot of transaction which is smaller in value.

How small are we talking about? To understand that you need to understand what interchange fees are!

Credit card networks ( think VISA, master card, Amex), banks and other intermediaries involved in the payment transaction takes a cut from your payment transaction as interchange fees for keeping their payment infrastructure alive.The interchange fees could be up to 2.75 % of your transaction amount size

So if your B2B customer is paying off an invoice worth 1000 dollars, 27.5$ would be shaved off by the intermediaries as interchange fee of which the banks which issued the credit card takes the highest cut! 20 dollars.

Now you know why banks are spending a ton of money marketing credit cards.

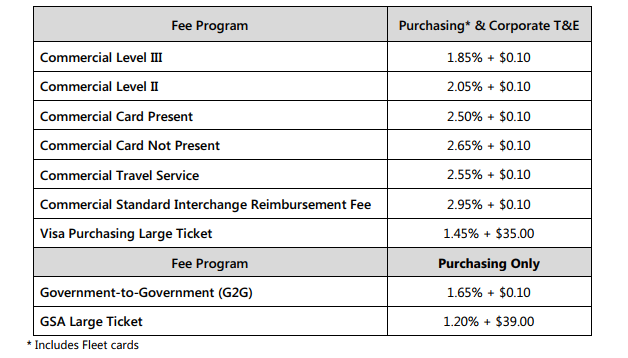

Latest visa interchange fees for B2B payments sheet https://usa.visa.com/dam/VCOM/download/merchants/Visa-USA-Interchange-Reimbursement-Fees-2015-April-18.pdf

As you can see the size of the transaction amount goes up the more the bank pay them. This is the reason why credit cards payments are more suitable especially when the invoice payment transaction size is lesser. There are certain ways how organizations in the B2B space can still reduce the credit card interchange fee they pay

1) Sending extra invoice information : While processing a credit card transaction, apart from regular information such as amount, credit card number, credit card expiry etc, A merchant could ask its software provider to send additional information such as invoice number, invoice tax amount, tax id , item description etc(Level 3/2 information).

Sending additional information reduces the chances of returns and hence credit card companies provide a discount on the interchange fee charged.

The discount could be up to 0.5 to 1 %.From 2.65 % interchange fee the interchange fee could be reduced to 1.85%(Check the interchange fees for Commercial Level 3 in the above image) by sending level 2/3 information.Talk to us to understand how –

2)Batch settlement: Some credit card companies allow batch settlement of transactions.

Instead of settling transactions as and when it happens, Processors aggregate all the transactions and settled them in one go. Please check with your software provider if they provide this option

3)Charge a convenience fee: Electronic transaction provides benefits to both you and your customers by reducing administrative overhead.

Most organizations charge their customers a convenience fee which offsets the interchange fee.Even with an extra convenience fee, most customers prefer electronic transactions due to reduced costs from reduction in administrative overheads

For higher transaction values it would make more sense to use other transaction methods, The most common being direct bank transfers

Accepting direct bank to bank transfers

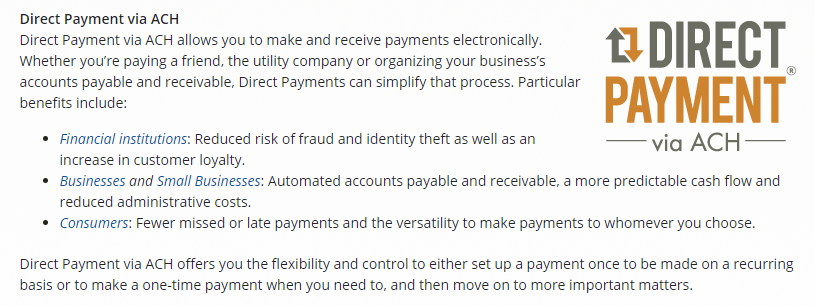

Source :NACHA website – Description of ACH payments from the NACHA website for US https://www.nacha.org

Direct bank transfer methods depend on the country/currency in which the bank account resides.Different countries have different names or methods for accepting such payments

Some of the major countries and their direct bank transfer methods are as given below

- US – ACH ( Learn more about US ACH here )

- Canada – CPA

- Europe – SEPA

- India – NEFT

- UK – BACS

US NACHA logo- Organization that runs the bank to bank transfer clearing house in US

How can you start accepting direct bank transfers?

The pre-requisite for accepting direct bank transfers is that you need to have a corporate bank account in the country in which you need to accept direct bank payments.

You will also need a software provider who can integrate with the bank to set up the connection to send payment files.In US the payment files are called NACHA files.Talk to us to understand how

Once the connection is setup your customers can enter their bank account number to make a payment with very little or no interchange fees.

By using the direct transfer option you are literally cutting away the middlemen ( Card companies + processors ) who take away a major percentage of the transaction amount as interchange fee

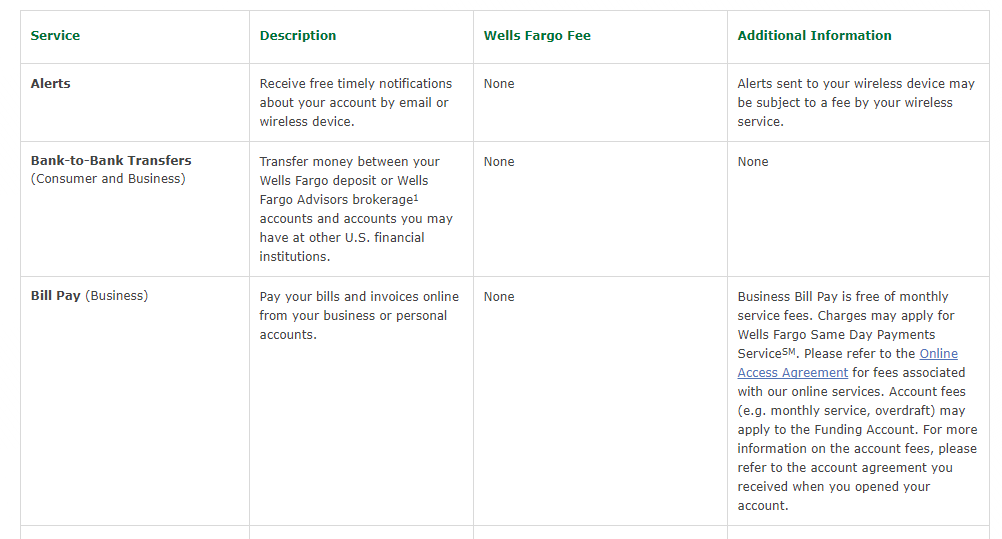

Screenshot showing charges for Wellsfargo bank-to-bank transfer fees

Downsides of bank transfers

Even though bank transfers has its advantages there are a few downsides to it which makes it unsuitable in some cases.Few of them being

- Delay in the actual settlement: ACH bank transfers usually have settlement times in the day during which actual fund settlements happen between banks.This means that even if the customer gives the authorization to make payment , the actual transaction happens later during the settlement time.This has some obvious downside one being if the customer account lacks sufficient funds in his account the payment transaction would get rejected during the settlement and this information won’t be provided real-time by the banks.With the introduction of Same day ACH , the time from actual payment to the settlement has reduced to within a day.

- B2B Payments in multi currencies/cross-border payments: Credit cards usually supports multicurrency/multicountry B2B payments by default.That is you could make a payment for a software you purchased from a US company even if your credit card was issued by a bank in Europe.This is not the case with bank transfers.bank transfers usually require your company to have a bank account in the country in which the customer bank account resides.This may not be a limitation for companies whose most of customers reside in the same country as the company.This issue can definitely be managed by allowing your customers both the option of credit card and direct bank transfer method of payments

Accepting paper checks and converting them to electronic payments!

Do you know that you can get your customers check processed without sending them to the bank!Yup its true

Source: BOA website – Showing how to obtain account number and routing number from a cheque received

This is how it works.

You can either manually enter the account number (in the check) ,routing number from the MICR data if you receive only a few number of checks on your payor-CRM portal(also known as EIPP software) or you could scan all your checks and use our software image recognition algorithm to capture account numbers and routing numbers .Once the account numbers are scanned the payment is sent to the bank as a payment file electronically as is done for bank transfers.You can then shred the checks provided by your customers after they have been scanned.By using this method Companies can avoid paying banks check processing fees also you will be cutting down on various reconciliation and handling overheads completely within your company. This process is facilitated by the Check 21 act https://en.wikipedia.org/wiki/Check_21_Act .If you don’t have your own check scanner you could ask the bank to provide a scanned image of checks it receives on your behalf.Most banks provide this service at a small cost.

Source : Federal reserve study on B2B payments methods in US.As can be seen, there is an increasing number of businesses converting Check payments to electronic bank-to-bank transfer (Shown as – converted to ACH in the above graph)

Deciding between the software to use for accepting B2B payments

Most EIPP software provides users/customers the option to pay through multiple options described above.

Some major features to look for in a B2B payments software are automated reminders, easier setup, security, Analytics etc.The software should be able to automate most of your task.For eg : You want to send a mail to all your customers whose invoices overdue by more than 90 days.The usual step is to look up your ERP system and identify the invoices which are overdue for each customer after which they need to be exported and copied onto a email body with description and a polite message referring to the overdue invoice.This step has to be repeated for all your customers whose invoices are overdue by more than 90 days.

The same action can be done as below.You can view and select the invoices from your cloud application product and select a template email with all the details prefilled and email will be automatically delivered to all your customers with overdue invoices .Compared to the previous steps , Using an EIPP software has completely cut down the effort required from you.More details on how to select the right B2B payments software here

So you have the software nailed and the payment method nailed! What next?

On onboarding and convincing customers.Most B2B payments software would use one or the other methodology to signup your customers.You could link your CRM/ERP customer data to the B2B payments software and the payment software would automatically provide your customers a login id and password to log in and view their invoices or your customers can themselves login and see their invoices and pay.Whatever methodology that you go with for signing up customers the whole experience would be as frictionless and painless as possible to ensure that your customers jump ship to make electronic payments

There are some time-tested ways that you could introduce your customer to electronic payments

- Going green! Most companies have gotten on the “going green bandwagon”.The older form of B2B payment method (checks ) in involves printing and mailing checks and remittance information which is essentially not very “green”.Using digital payments Companies can cut down the usage of paper, fuel and printing ink and equipment and helps in saving and preserving the environment

- Overdue payments and blocked orders :If one of your customers has used up their credit limit and have a blocked order, suggesting them that they could use electronic payment method to clear off overdue invoices quickly would be a easy way to convert them to electronic payments .

- Electronic invoices : Sending electronic invoices(invoices over email) reminders with a “Pay now” button to your customers , even for customers who are receiving invoices hard copy invoices through mail would be a great way to convert your current customers to electronic payment.The idea behind this strategy is that your customer might someday decide to make the switch to electronic payments.Your invoice reminder with payment option will make it known to them that you are ready for electronic payments whenever they are ready

- Charging your customers extra for paper invoices/check payments : Paper invoices and check payments involve a lot of administrative overhead both at your end , at the bank both the originating bank and destination banks.Asking your customers to pay for these overheads are a sure-shot way of switching them to electronic invoices

Bonus ! Marketing messages through your invoices!

Unlike marketing messages through email blasts , Invoice reminders have a higher open rate and are most likely to be shared and seen within the organization for reconciliation purposes.What better a medium that your invoice reminders to upsell and update your customers about new products, features, and sale than invoices?

Having an EIPP software which provides you this feature would help the finance team contribute to the company’s revenue through upselling even though this is not what finance/collections team are meant to do.

Reconciliation

Reconciliation is another big piece when it comes to B2B payments.How can we ensure that the credit card/bank transfer transaction done electronically was really successful.To check that you need to check all the payments that came into your bank account.Also, you would need to check which of the payments that came in was for which of the invoices /customer payments.Doing this manually again is a pain.Banks again provide a solution where they would send your software provider a remittance file which has all the payments and the invoice numbers for the payments.Processing the remittance information isn’t an absolute necessity.It’s more a way to double check if the money has really reached the bank Accepting B2B payments using credit cards ,direct bank transfer

Also published on Medium.