Are you ready for Same day ACH bank to bank transfers ?

Same day ACH bank to bank transfers

NACHA after a long wait has introduced Same-day ACH bank to bank transfers.

Companies accepting payments through ACH extensively can get paid within a day now instead of having to wait upto 5 days.

What does it mean for your business ?

Businesses which receives large payments ( more than 10,000 USD ) can now breathe a sigh as of relief as they would have access to funds their customer had transferred faster than ever before.

Accepting ACH payments through Quickbooks ACH, Stripe, Authorise.net etc has the downside that it takes up to 5 days for the payments to settle.

By using a direct ACH connection with your bank, Your business can ensure that your funds settle faster!

Classic ACH Vs Same day ACH

Previously if you were settling transaction directly with your bank , Your payments would settle through the classic ACH route.Such transactions would take upto 1-2 days to settle.

Businesses, which has opted for Same day ACH , would from now on receive ACH payments initiated by their customers settled within a day

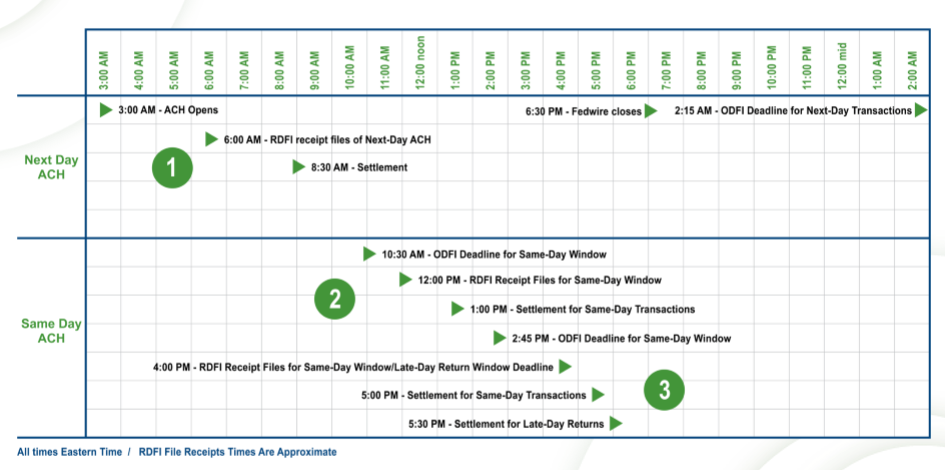

Differences in the timings of Same day ACH and Classic ACH

Classic ACH – With classic ACH if a customer makes a payment on Nov. 30 ,your business will receive payment amount in your bank account on Dec 1

Same Day ACH – If your customer makes a payment on Dec. 1, You will receive the payment in your bank account on Dec 1 itself

In the diagram above you can see that if the transaction information reaches the bank before 4 pm , The transactions will be settled by the 5.30 pm settlement window in the same day in case of Same Day ACH !

Settlements in case of Same day ACH could happen in 2 settlement windows every day ( 2.45 pm or 5.30 pm)

Why Should You switch to same day bank to bank service?

One of the advantages of accepting credit card payment was that the settlement happens instantly ,but this convinience came at a huge cost of high interchange fee(2% – 3% of the transaction cost ).

With same day ACH bank to bank payment service you will be able to get payments settled within the day and with almost nil interchange fee (close to 50 cents for one transaction).

For B2B payment transactions Same day Ach is the best thing that could happen!

Other benefits

Treasury: improved working capital/cash flow management/hurdle rate

Operations: reduced cost for expedited payments; improved invoice processing/payment cycle time; faster supplier cash application with the inclusion of remittance; quicker acquisition of supplies/services •

Customer Service: predictable timing for disbursements/payouts saves costs for payment receiver Low cost, ubiquitous option to expedite payments and can reach any bank account in the U.S.

Reconciliation becomes easier: As the return information(whether the transaction was rejected by the network) and settlement information (whether the money has reached your account) is received faster the reconciliation will become easier.

Costs of Same day ACH service

Same day ACH is a free service provided by the NACHA network but some of the banks may charge you a small fee and some may provide this service for free

Please do check with your account manager at the bank to understand the costs involved.

Quickbook users

If you are a Quickbooks user and wants to reduce the number of days it takes for ACH payments to be settled from 5 days to 1 day , Please send a mail to [email protected] with the name of your Bank.We will work with your Bank to setup a direct connection through PayorCRM

For more information, visit www.nacha.org/same-day-ach

Also published on Medium.