Why setup Automated Recurring ACH payments or Credit card payments with QuickBooks

We wrote a blog post on QuickBooks(Desktop/Online) ach payment issues see here –

And realized that out of the issues mentioned , There is something that we haven’t solved yet – Recurring ACH payments

Why use Recurring ACH payments instead of recurring credit card payments ?

ACH payment are the cheapest and easiest payment mechanism out there.

QuickBooks only allows you to setup recurring Credit card payments while it doesn’t allow Recurring ACH payments ( may be because QuickBooks provides ACH for free while marks up credit card transaction fees ).

For Recurring Payments , ACH payment method would be a much better choice than credit card for the following reasons

1) ACH is the Cheapest form of payment acceptance when compared to credit card payments ,which costs upto 2.9% of transaction amount, as ACH payments are almost free ( see the cost of accepting payments through credit card here )

2) Easiest because almost everyone has a bank account and hence anyone can pay via ACH.

Who would need this feature of automating payments processing ?

Any business which has more than 10 customers Bank account or Card on file will find value in setting up an automated payment mechanism for those customers.

By doing so your business would have to spend zero hours having to manually process those recurring card payments or recurring ACH payments. Imagine the amount of man-hours spent saved through that!

The above calculator can be used to find out how much your business would be saving by automating recurring credit card payments or recurring ACH payments

(Considering normal salaries of $23.00 to $33.00 /hour)

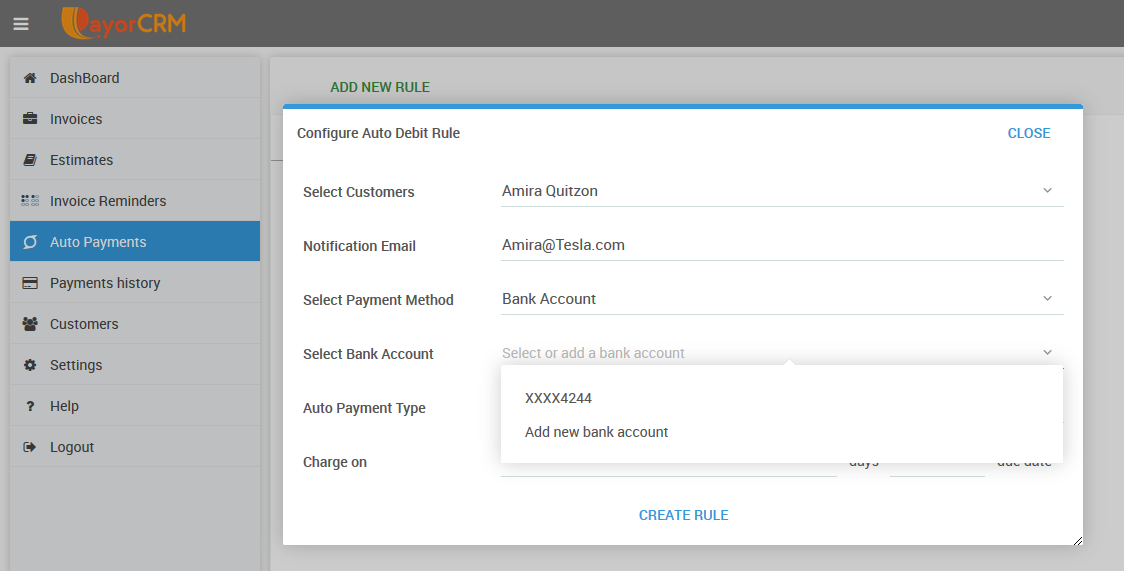

Who can set a recurring ACH payment on PayorCRM ?

Either you or your customers can setup recurring ACH payments or credit card payments.

What is the trigger for the payments to be processed on PayorCRM ?

This could be anything from

- Processing invoice x days before due date

- Processing invoice whenever it is created

- Processing invoice x days after due date

- Processing invoice with invoice amount less than xxxx and y days before due date .. etc

Check our help section on the steps to setup recurring ACH / Credit card payments on PayorCRM –

Also published on Medium.