Using QuickBooks payments? Save more than 5000 dollars a year

Are you using QuickBooks payments for accepting Credit Card Payments? You are then one of the many users of QuickBooks overpaying for accepting credit card payments

How do we know ? We did the math and you can try finding how much your business will save too using the below calculator

Enter the total amount of payments accepted through credit cards in your business below under “Monthly payments received via Credit cards” to find how much you could be saving.

We decided to do an analysis recently the amount of fees Customers are paying for accepting payments through credit cards and realized that QuickBooks Payments has been overcharging them. Apart from all the other issues with accepting payments through QuickBooks ( see here) QuickBooks makes a neat margin thanks to its higher than average credit card fees.

How does QuickBooks Payments get away with the high charges ?

QuickBooks Payments have integrated themselves well with the QuickBooks app and they have made it way easy for customers to start accepting card payments through them. They also started giving away their ACH services for free even though the same is discounted by the high credit card charges ( As they say “There is no free meal” )

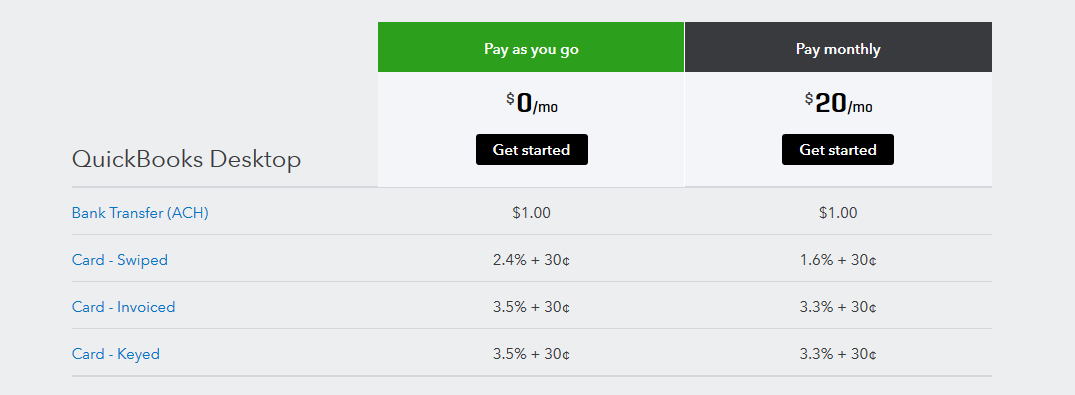

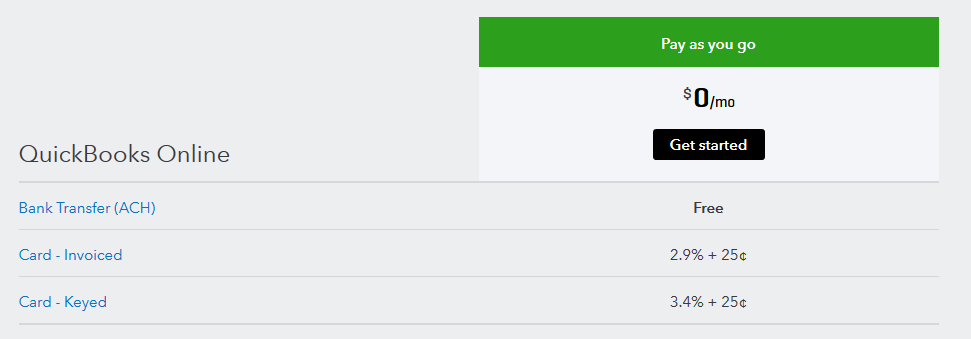

Below are screenshots from Quick book payments portal showing their charges

For QuickBooks Desktop charges as of August 2018

For QuickBooks Online charges as of August 2018

Note : “Card – keyed” refers to payments made by the customer by keying their card number on a website ( This is the usual way most companies accepting payments through Quickbooks

If you are using a third party credit card provider ( for eg: Bank of America merchant services ) the charges would be on an average around 2.35 % – 2.5% for a business doing upto 40,000 USD worth of transactions ( This could be much lesser if you have a higher volume of transactions).By marking up the card acceptance prices QuickBooks is clearly earning a neat margin for every payments you receive from your clients.

PayorCRM has tied up with credit card and ACH service providers that can provide the best rates . Apart from the savings of using a cheaper payment processor via PayorCRM , Your Business can also get the benefits of automating and managing your receivables by using an automated receivables management software.

Reach out to us at [email protected] to find out how much money you could potentially save in just credit card acceptance charges.

Also published on Medium.

Pingback: Why setup Automated Recurring ACH payments or Credit card payments with QuickBooks - PayorCRM()